As the year closes, let’s go over some of the things we talked about this past year that empowered and helped us to become better and more responsible taxpayers.

In this article:

Top Articles of 2018

1. What Can You Write Off on Your Taxes

Do you wonder what can you write off on your taxes? There are indeed some items you can write-off on your taxes if you have a business. We just need to determine what these are so you can reduce our taxes. In this article, we give you some examples of things you can use to lower your taxes. Click to read The 5 Things You Can Write-Off From Your Taxes.

2. Different Types of Taxes We Pay in the U.S.

Part of every American’s civic duty involves the proper declaration and payment of different types of USA. taxes. Taxpayers usually owe their taxes either to the federal or state government, though some of them are automatically included in the purchase of goods or services. Click to read Different Types Of Taxes We Pay In The U.S.

3. How Accurate Is Turbo Tax Calculator

The Turbo Tax Calculator is tax software that aids in tax preparation. It was developed by Chipsoft, now Intuit Incorporated, in the mid-1980s. Turbo Tax has since become one of the most popular tax software programs in the United States. Click to read How Accurate is Turbo Tax Calculator.

4. Income Tax Rates by State

Looking for a detailed list of income tax rates by state? It can get a bit complicated if you try to break it all down by all types of taxes, especially since the 50 states follow different tax rates than the federal income tax brackets. But here, we’ll give you a more detailed view of the Tax Foundation’s data on income taxes by each state so you will be prepared for the next tax season. Click to read Income Tax Rates By State.

5. Delinquent Taxes | Everything You Need to Know

Having delinquent taxes can be frightening, but when you know the basics, you can make a sound plan. Click to read Delinquent Taxes | Everything You Need To Know.

6. The Master List of All Types of Tax Deductions

Tax time is just a few months away, and it helps to know the types of tax deductions that will help people save some money. Remember, most tax deductions will qualify only when itemized. Nobody wants to pay taxes, so check out this tax deductions list to lessen tax loads. Click to read The Master List of All Types of Tax Deductions.

7. What Tax Forms Do I Need to File for an LLC?

“What tax forms do I need to file for an LLC?” This question appears as a usual concern for those who set up an LLC (or a limited liability company). According to the Internal Revenue Service (IRS), LLC tax filing requirements are based on the company’s classification and the number of members. Here’s a rundown of the classifications provided by IRS, and the corresponding tax forms an LLC needs to file. Click to read What Tax Forms Do I Need to File for an LLC?

8. How Long Does It Take to Get a Tax Refund

The first question most people have when they file their tax returns is “When will I see my refund?” That stands to reason, because who doesn’t want more moolah, especially in the aftermath of the financially intense holiday season? Here’s your brief primer on how long a tax return takes, what the refund process looks like and what’s going on if you don’t see your refund in the estimated timeframe. Click to read How Long Does It Take to Get A Tax Refund.

9. W2 Tax Form | Everything You Need to Know

All Americans must file the W2 tax form, one of the most basic tax forms, every year. For many people, it presents a big challenge. Some might even say they feel quite overwhelmed and intimidated in filling out the form. However, all it takes is a little know-how on how the W2 form works to be able to file it effectively. Here is a quick but comprehensive guide to everything you need to know about the W2 tax form. Click to read W2 Tax Form | Everything You Need to Know.

10. 5 Standard Tax Deductions for Retirees and Seniors

Trying to find standard tax deductions to make tax dues manageable can be pretty challenging for retirees and seniors. What are the different types of tax deductions elders can take advantage of? There are, in fact, quite a few. Click to read 5 Standard Tax Deductions for Retirees and Seniors.

Videos of 2018

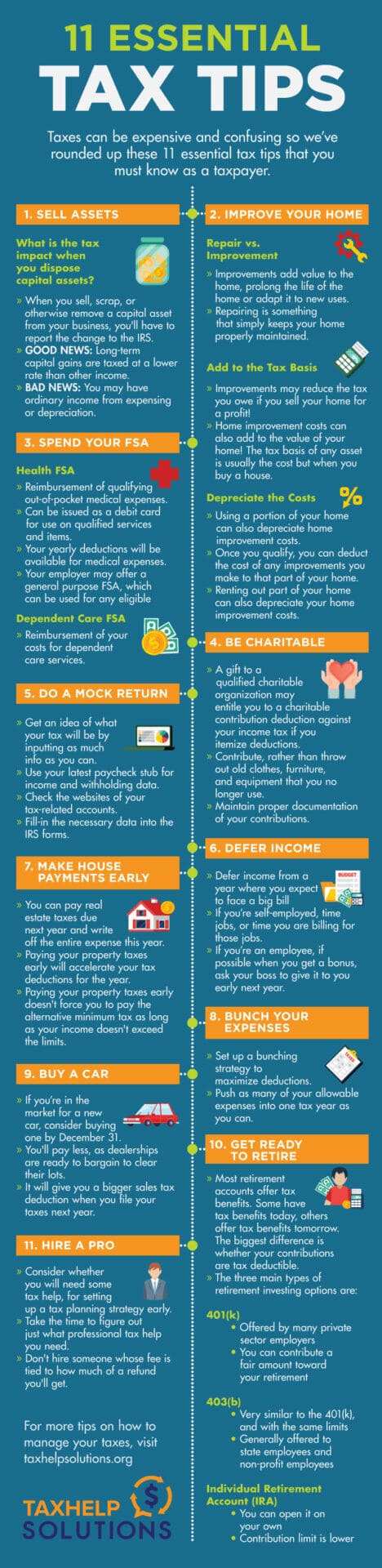

1. 11 Essential Tax Tips for the Holidays

2. 5 Things You Can Write Off from Your Taxes

3. 9 Types of TAXES You’re Probably Paying but DON’T KNOW About!

4. 6 Things You Didn’t Know You Could Deduct from Your Taxes

5. 6 U.S. Tax Forms You Should Know

6. Filing Late Taxes

7. The Master List of All Types of Tax Deductions

8.Home Improvement Tax Deductions

9. Taxes You Can Write Off When You Work from Home

10. 10 Weirdest U.S. Taxes

Infographics of 2018

1. Essential Tax Tips for the Holidays You Need to Do

With the Holiday spirit in the air, it may sound absurd to think about tax tips. However, if you consider tax season tips, it will give you certain advantages in the coming year when it is time to file your taxes. Click to read 11 Essential Tax Tips for the Holidays.

2. 5 Things You Can Write-Off from Your Taxes

Do you wonder what can you write off on your taxes? There are indeed some items you can write-off on your taxes if you have a business. Click to read 5 Things You Can Write-Off From Your Taxes.

3. 9 Types of USA Taxes

Part of every American’s civic duty involves the proper declaration and payment of different types of USA taxes. Click to read Different Types Of Taxes We Pay In The U.S.

4. IRS Tax Forms | Things You Need to Prepare Before Filing

Filing the right IRS tax forms and providing proof of eligibility to claim tax deductions or credits can legally reduce your financial obligations to Uncle Sam. Generally, you need certain information and documentation when filing your tax return to the IRS. Click to read IRS Tax Forms | Things You Need to Prepare Before Filing.

5. 6 US Tax Forms You Should Know

There’s a lot of US tax forms available, and it is probably difficult for a taxpayer to figure out those that are highly relevant and necessary for him or her. Click to read 9 US Tax Forms and Their Purpose.

6. How to File Late Taxes

Having delinquent taxes can be frightening, but when you know the basics, you can make a sound plan. Click to read Delinquent Taxes | Everything You Need To Know.

7. Tax Deductions Master List

Remember, most tax deductions will qualify only when itemized. Nobody wants to pay taxes, so check out this tax deductions list to lessen tax loads. Click to read The Master List of All Types of Tax Deductions.

8. 7 Home Improvement Tax Deductions for Your House

Home improvement tax deductions, what are they? Lucky for you, we have a list of home improvements that qualify as tax write-offs! Click to read 7 Home Improvement Tax Deductions for Your House.

9. Taxes You Can Write Off When You Work from Home

Aside from the flexibility and convenience of working from home, you can also benefit from a number of taxes you can write off from using your own space for business. Check out the comprehensive list of what can you write off while working from home. Click to read Taxes You Can Write Off When You Work From Home.

10. 10 Weirdest US Taxes

These are 10 of the weirdest, and sometimes ridiculous, taxes in America. Click to read 10 Weirdest US Taxes.

11. How Business Taxes Are Affected Under the New 2018 Tax Law

These are some significant changes affecting business taxes since the implementation of this new law. Click to read How Business Taxes Are Affected Under the New 2018 Tax Law.

That wraps up our 2018! We hope you had a wonderful year. Let us know your favorite part in the comments below.