Let the Tax Relief Center clear any of your confusion on self-employment tax by answering key questions about this tax obligation.

RELATED: Self-Employment Taxes: Things To Watch Out For

In this article:

- What Is Self-Employment Tax?

- Who Pays Self-Employment Tax?

- What Are My Tax Obligations If I’m Self-Employed?

- What Is the Self-Employment Tax Rate for 2019?

- When Are Self-Employment Taxes Due?

- What Tax Forms Do You Use for Self-Employment Taxes?

- What Are Self-Employment Deductions?

- How Can I Avoid Self-Employment Tax?

- Can You Use Self-Employment for Tax Credits?

- Are Self-Employment Taxes Higher Than Employee Taxes?

- How Are Self-Employment Taxes Calculated?

- What Methods Can I Use to Pay Self-Employment Tax?

- Can I Pay Self-Employment Taxes Monthly?

What You Need To Know About The Self-Employment Tax

1. What Is Self-Employment Tax?

The self-employment tax is a tax obligation the government foists on individuals who earn income from a business or a professional practice. The self-employed pay for this tax in lieu of Social Security and Medicare taxes.

2. Who Pays Self-Employment Tax?

The IRS makes the following distinctions to check a person’s eligibility for self-employment tax:

- You own a trade or a business, or you’re an independent contractor

- You’re a partner in a partnership-owned business or trade

- You’ve literally employed yourself in a business you made, even if it’s a part-time stint

Based on the above definition, business owners, professionals, and freelancers fit into the self-employed category. Anyone who earns $400 or more from their business or service has to pay self-employment tax.

3. What Are My Tax Obligations If I’m Self-Employed?

- Self-employed individuals have to file an annual income tax return and pay their taxes quarterly.

- Self-employed individuals have to pay both income taxes and self-employment taxes. Self-employment tax serves as the Social Security and Medicare contributions of self-employed individuals, and funds those two safety nets.

- Self-employed individuals must pay a specific yearly percentage people refer to as the FICA tax rate after the Federal Insurance Contributions Act (FICA). Taxpayers can break down the FICA tax rate into two parts:

- The Social Security Tax, pegged at 6.2% of the first $128,400 of an individual’s net income

- The Medicare Tax, pegged at 1.45% of all of an individual’s net income

- The government calculates the FICA tax rate of self-employed individuals as double of an employed taxpayer’s. Self-employed individuals have to pay both the employee and employer’s portion of the FICA tax.

4. What Is the Self-Employment Tax Rate for 2019?

The government obliges self-employed individuals to pay a 15.3% self-employment tax rate on the first $132,900 of net income and 2.9% on top of the amount exceeding $132,900.

5. When Are Self-Employment Taxes Due?

Self-employment taxes are due every quarter, and every self-employed person must pay them as estimated taxes since they are solely responsible for themselves when it comes to withholding taxes.

Kindly pay your estimated tax in the correct amount on or before their due dates to avoid tax penalties for underpayments or late payments.

6. What Tax Forms Do You Use for Self-Employment Taxes?

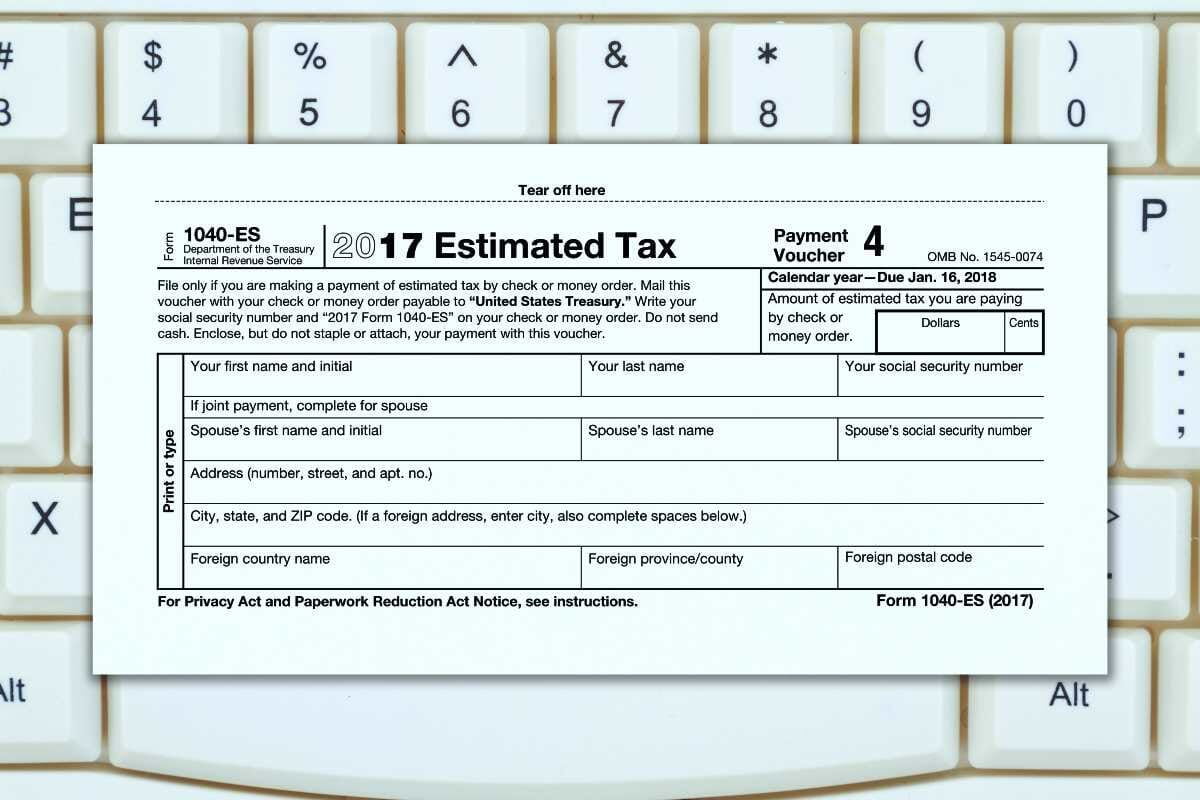

Self-employed individuals must use Form 1040-ES or Schedule SE to figure out and pay their self-employment taxes. The form contains worksheets self-employed individuals can use to make projections of their net income and determine how much self-employment tax they can pay.

The same form contains vouchers self-employed taxpayers can use to send their payments to the IRS.

RELATED: Estimated Taxes | How To Determine How Much You Should Save

7. What Are Self-Employment Deductions?

When tax specialists talk about self-employment tax deductions, they mean specific line items self-employed individuals can subtract from their gross incomes or adjust their income taxes.

These deductions only impact the income tax and not self-employment tax.

The upside is the IRS allows self-employed individuals to deduct the employer portion of their self-employment taxes from their gross taxable incomes as the service considers this a business expense.

8. How Can I Avoid Self-Employment Tax?

You can only minimize self-employment tax by increasing your business expenses so your net income from your self-employed activities become smaller.

If you want to use tax avoidance methods to minimize your self-employment tax, please seek the help of a professional tax specialist.

9. Can You Use Self-Employment for Tax Credits?

There is a tax credit called the Earned Income Tax Credit (EITC) reserved for workers with low to moderate incomes, and business owners. Again, this tax credit affects income tax and not self-employment tax.

10. Are Self-Employment Taxes Higher Than Employee Taxes?

Yes, since self-employed individuals must pay the employer and employee’s portions of the Social Security Tax and the Medicare Tax.

11. How Are Self-Employment Taxes Calculated?

You will have to figure out how much net profit you’ve earned from your self-employed activities by subtracting your expenses from your gross revenue. Just calculate 15.3% of your net profit and you’ll arrive at how much self-employment taxes you should pay.

Please take note that the government levies an additional Medicare tax of 0.9% if you exceed the following net earning thresholds:

- Married and filing joint tax returns: $250,000

- Married and filing separate tax returns: $135,00

- Single, Heads of Households, Qualified Widows and Widowers: $200,000

People who earn salaries and self-employment income can reduce this additional Medicare Tax by the number of wages subject to an additional Medicare tax.

You can also use self-employment tax calculators online from tax software companies to figure out how much you need to pay if you want an easier method.

12. What Methods Can I Use to Pay Self-Employment Tax?

Form 1040-ES possesses empty vouchers you can use to send in your self-employment tax payments. You can also use the Electronic Federal Tax Payment System or EFTPS to pay your tax obligation online.

13. Can I Pay Self-Employment Taxes Monthly?

The IRS divides the year into four payment periods, so you really need to pay the self-employment tax on a quarterly basis. You can divide your quarterly payments by three and save this amount per month and keep it in a safe place until your self-employment tax is due.

The self-employment tax will sting like most taxes. Let’s not forget that your payments towards this tax obligation go to Social Security and Medicare, which ultimately benefit you when you retire or get sick.

Are you a self-employed individual? What other aspects of self-employment and taxes do you want some clarity on? Please give us your answers in the comments section below.

If you owe back taxes, visit taxreliefcenter.org for more information on tax relief options.

Up Next:

- What Happens If You Don’t File Your Taxes For 5 Years Or More?

- What Is An IRS Backup Withholding Notice And How To Deal With It

- Different Types Of Taxes We Pay In The US [Infographic, 2019 Updated]