Both employers and freelancers feel the negative effects of backup withholding, making being informed crucial in tax preparation and penalty avoidance.

RELATED: 11 Tax Sins Not To Commit To Avoid Tax Fraud Charges

In this article:

- What Is Backup Withholding?

- Is Backup Withholding Bad?

- How Do I Know If I Am Not Subject to Backup Withholding?

- Who Are Exempted from Backup Withholding?

- What Payments Are Not Subject to Backup Withholding?

- Which Assets Can Have Backup Withholding Attached?

- What Can a Taxpayer Do to Prevent Backup Withholding?

Frequently Asked Questions About Backup Withholding

What Is Backup Withholding?

Simply put, backup withholding happens when the IRS orders a taxpayer to withhold taxes from a non-employee due to conflicting information regarding SSN, TIN, EIN (Employer Identification Number), or other pertinent tax information.

The IRS asks the employer to withhold 28% (now 24% for the tax year 2018 and 2019) to ensure that the government collects the appropriate taxes from the non-employees.

However, employers do not have to file taxes for non-employees. These contractors have to file the taxes themselves.

What the backup withholding focuses on is efficiency. Specifically, some independent contractors use a different SSN or TIN during tax reporting, which causes unproductive stops in the IRS tax process.

Of course, sometimes the difference in TIN can be due to an innocent mistake, like lacking an extra number or having too many numbers. However, the employer-taxpayer has the responsibility of performing the tax withholding if the information given by the non-employee is erroneous.

Lastly, backup withholding can apply if there is an underreporting of interest or dividends, which the IRS can check when companies report dividend distribution.

Interestingly enough, failure to certify that the taxpayer does not incur backup withholding can lead to backup withholding applied. Taxpayers should always ensure that they filled out the whole tax report properly, as missing a few certifications and signatures can lead to the imposition of unnecessary penalties.

The IRS informs the taxpayers through CP2100 or CP2100A Notice. The IRS sends a CP2100A for individual taxpayers and CP2100 for taxpayers who file large amounts of taxes.

Is Backup Withholding Bad?

For the business owner or employer, the backup withholding may seem to cause unnecessary delays.

Also, more experienced taxpayers can foresee that double taxation might occur, especially if both the employers and independent contractors do not communicate.

For example, let us assume that both parties, the business owner and the freelancer, waited until April to file their tax reports.

The independent contractor may have sent a W-9 with an incorrect TIN to the business owner. On the other hand, the business owner noticed that the TIN lacks a single number and withheld taxes for the non-employee.

In this case, the independent contractor and the employer may have sent the taxes twice. Double taxation occurs in this instance since the same subject, the wages, have the same tax (in this case income tax), applied twice with varying rates from different persons.

The IRS may send the tax refund. However, tax refund typically takes time, and the IRS may just simply apply the excess as a tax credit.

For both parties, backup withholding may sound like a bad idea. However, the state needs taxes to operate, and this process is in place so that the government can provide necessary services without worrying about not collecting the taxes.

How Do I Know If I Am Not Subject to Backup Withholding?

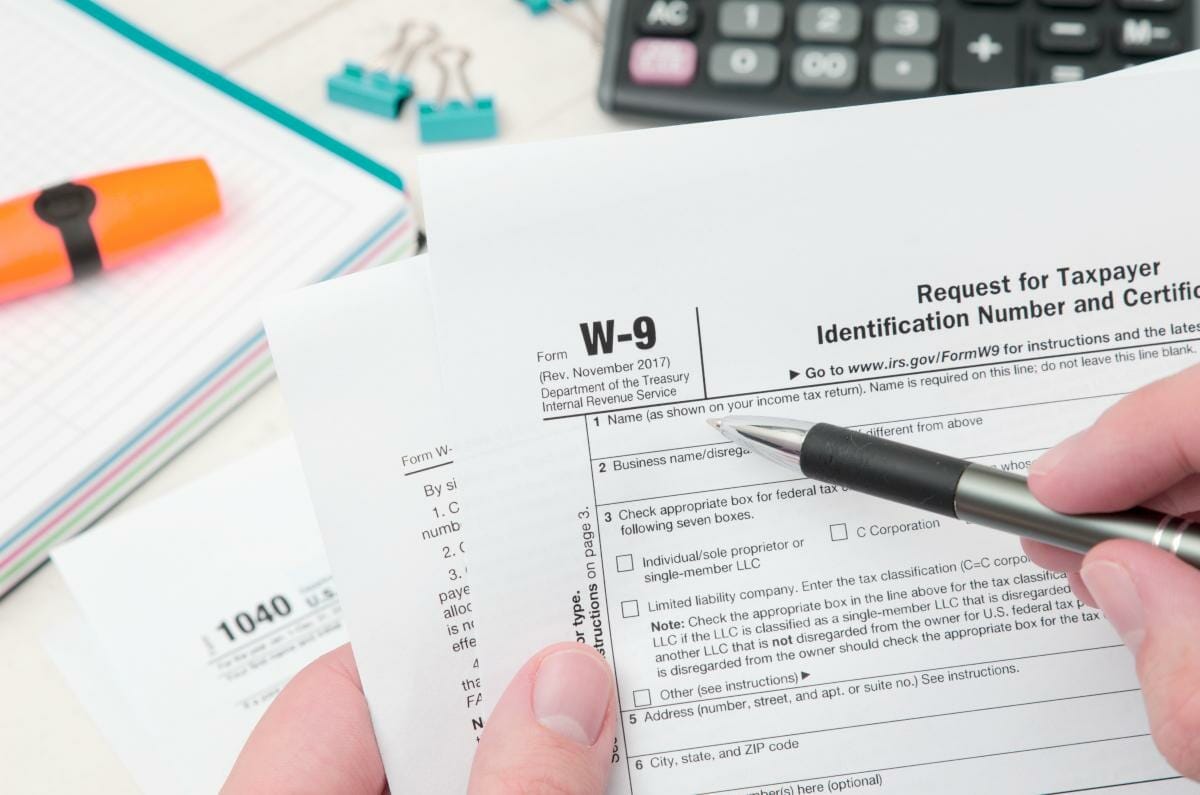

Simply put, a taxpayer does not need to do backup withholding if the TIN, SIN, or EIN in the W-9 submitted is correct.

To clarify, if the tax information in the W-9 submitted by the employer matches with the IRS records, the employer does not have to pay backup withholding. If the mistake is on the part of the freelancer, the IRS will contact the non-employee and possibly levy some penalties and fees.

Also, the taxpayer can rest easy if the IRS did not send a notice or letter informing that backup withholding applies.

However, do note that even if the independent contractor has paid the taxes, the IRS can still ask for backup withholding if there are discrepancies in the tax information. This situation is true if the mistake regarding tax information comes from the employer’s tax report.

The exemption to backup taxes applies to both citizens and aliens working and residing in the country.

RELATED: What Happens If You Don’t Pay Taxes? | Consequences And Penalties

Who Are Exempted from Backup Withholding?

The following do not have to withhold backup taxes for freelancers:

- The Federal Government and Federal Institutions

- State entities, whether they are agencies or departments as long as they function for the state and not for profit

- Foreign governments

- Dealers in Securities and Commodities (basically brokers that trade and invest in stocks)

- Financial institutions

- Custodians

Of course, the list can change, and is not exhaustive. However, if the taxpayer is an individual or a small/medium business, chances are high that backup withholding can apply.

What Payments Are Not Subject to Backup Withholding?

- Payments to foreigners who are not residing in the country

- Dividends not paid in the form of money

- Payments of interest up until $599. If the payment reaches $600, that may constitute as reportable income and hence, income that can be part of backup withholding

- Tax refunds, whether state or federal

- Distributions from an IRA

- Funds from a medical or health savings account as well as long-term care benefits

- Unemployment compensation

- Forgiven or canceled debts (some debts are reportable but not subject to backup withholding)

- Foreclosures

This list does not contain all exemptions, and a taxpayer may want to ask a tax professional for assistance.

Which Assets Can Have Backup Withholding Attached?

Most of the items that need to show up in a Form 1099 can have backup withholding attached.

To enumerate, these items are:

- Wages

- Commissions performed as an independent contractor

- Winnings from gambling

- Interest income $600 up

- Payments from brokers

- Dividends that are at least 50% cash, money or equivalent

- Royalties

If a taxpayer wants a more detailed list, looking at a 1099 Form can help taxpayers pinpoint which income is applicable for backup withholding.

Freelancing taxpayers may want to know more about backup withholding, to avoid double taxation as well as penalties. Business owners will want to avoid backup withholding, as tax refunds may unnecessarily take out needed cash for business operations.

What Can a Taxpayer Do to Prevent Backup Withholding?

For independent contractors, making sure that the IRS and the employer have accurate tax information will reduce the chances of having backup withholding. While backup withholding may come from the pockets of employers, the freelancer gets penalties, as well as smaller net pay, if tax inaccuracies remain on file.

For business owners and employers, preparing tax reports months earlier can make inaccuracies easier to spot. Early tax preparation means more time to get back to the freelancer and correct either the IRS records or the W-9 sent.

Backup withholding is an added burden to taxpayers, employers and independent contractors alike. Knowledge about why it has to exist in the first place can help taxpayers avoid paying it, which means more net pay as well as fewer problems when tax season comes.

Have you experienced the backup withholding process? What are your thoughts about it? Let us discuss in the comments section below.

If you owe back taxes, visit taxreliefcenter.org for more information on tax relief options.

Up Next:

- 3 Legal Programs That Will Help You Get Out Of Tax Trouble

- IRS Tax Debt Relief | 9 Ways To Settle Your Tax Debts

- Simple And Practical Frugal Living Tips You Can Start Doing Today