When you have not filed your taxes on time, you will need to file back taxes. The back taxes definition is the taxes you failed to file. It is illegal to ignore your taxes and you must file the paperwork to avoid a jail sentence. Filing back taxes starts with clarifying the appropriate steps to avoid mistakes.

How To Avoid Back Tax Problems

In this article:

- Step 1. Clarify the Year You Missed

- Step 2. Gather the Information

- Step 3. Fill Out the Forms

- Step 4. Set up a Payment Plan

Step 1. Clarify the Year You Missed

If you do not file back taxes within three years, then you will not receive any tax returns. It can also cause problems with your social security if you are self-employed, so you may want to handle the problem early.

When you receive notice that you must file back taxes, clarify the date. You can then ensure that you have the right data for the tax paperwork. When you owe back taxes for several years, pay attention to the dates and follow through with the appropriate paperwork.

Step 2. Gather the Information

Gather the data related to the year of taxes. Find any W-2 forms, 1099 forms or other tax documents for the year or years you missed on your taxes. If you do not have the information, then contact old employers for the data. Keep in mind that your employers do not always keep records for previous years. By filing the paperwork quickly, you will have a higher chance of finding the information from an employer.

If you do not have the paperwork and an employer does not keep the records, then contact the IRS. Request a Form 4506-T or a transcript of your tax returns for the year. The IRS will have records of previous tax years from your employers. It may take time to receive a transcript in the mail.

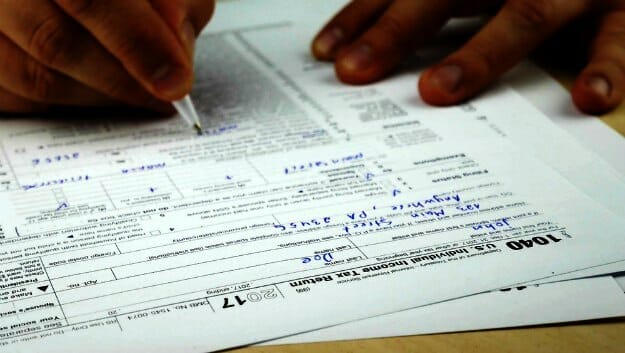

Step 3. Fill Out the Forms

Use a Form 1040 to fill out your information. Follow the instructions and fill out the requested lines of data. The information will require your name, address, and social security number. Use your W-2 or 1099 forms, or the transcripts from the IRS, to fill in the requested lines of data. The data you provide depends on your paperwork.

You can fill out the form and send the paperwork through the mail. You can also use tax software to file your taxes online. The online software simplifies the process and sends the paperwork to the IRS within a few days. If you need to complete the paperwork quickly, then using an online service or tool will speed up the process. An online tool also allows you to fill out the back taxes for your state.

Step 4. Set up a Payment Plan

Owe back taxes? Use our online portal to set up a payment plan. Fast, convenient, & available 24/7 https://t.co/248CUWXxQk #ksleg #Kansas pic.twitter.com/tZev9PjNa4

— Kansas Revenue (@KanRevenue) October 6, 2017

The final step of filing back taxes is setting up a payment plan. If you owe money to your state or the federal government, then you must pay the funds after filing your back taxes. When you do not have the funds available, set up a payment plan.

A payment plan is negotiated with the IRS. The IRS allows you to set up a payment plan for 90 to 120 days by using their Online Payment Agreement application. You can also call the IRS at 800-829-1040 to set up a payment plan. If you need more time to pay the back taxes, then you can negotiate with the IRS to set up a plan that works for your budget. They may ask for information about your financial responsibilities and your income to help with the process.

Here’s a video by WBAL-TV 11 Baltimore where tax questions are answered on filing back taxes:

Filing back taxes is a process and it takes time. If you ask for a transcript from the IRS, then you will need to plan for a few weeks to complete the process. By filing the paperwork early, you have credit for your social security. In some cases, you may also receive a refund on your taxes for that year.

Do you have any other back tax problems? Were there any back taxes penalties? Let us know in the comments section below.

Up Next: How Do Tax Resolution Services Work When Owing Back Taxes