Here are the important things to keep in mind on how to file a tax extension to avoid tax penalties.

RELATED: A Step-By-Step Guide To Settling IRS Tax Debt

In this article:

- When Is the Tax Return Annual Deadline?

- When Should You File a Tax Extension?

- What Happens When You Get an Extension?

- What Is the Purpose of a Tax Extension?

- How Does TurboTax Work?

- How Do You File a Tax Extension Directly to the IRS?

- What About State Returns?

- What Are the Special Rules to Extend a Tax Deadline?

- Why Is It Important to Do Your Own Tax Estimate?

What You Should Know About How to File a Tax Extension

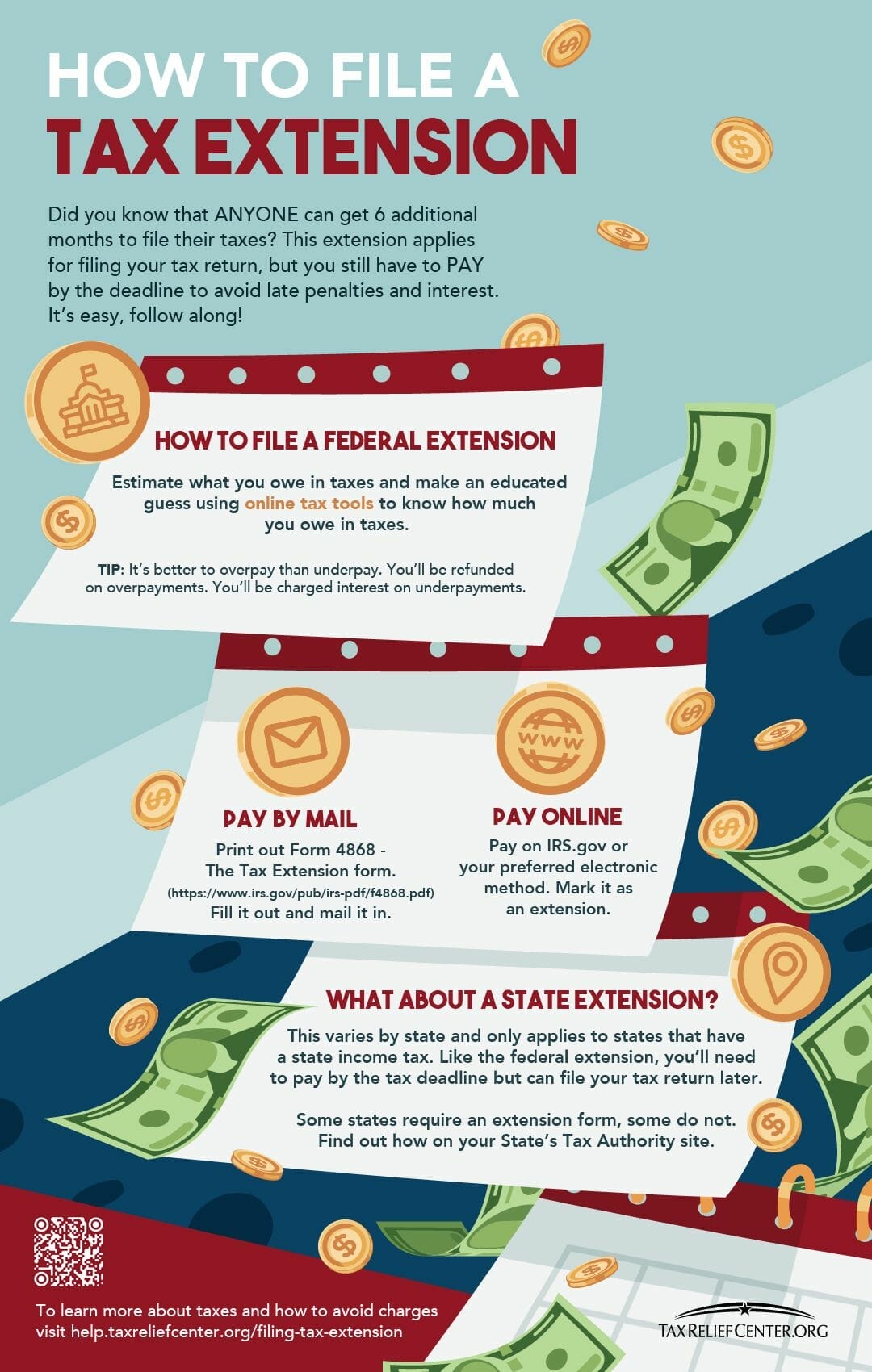

Click here to jump to the infographic.

When Is the Tax Return Annual Deadline?

Filing a tax extension is not uncommon. In some situations, it may be necessary to take this step if you cannot complete your tax return by the annual deadline, which usually falls on April 15.

It is possible to use a TurboTax extension service or an IRS e-file extension in some cases. But, before you learn how to file a tax extension, there are a few things you need to know.

When Should You File a Tax Extension?

Whenever possible, complete your taxes on time or you will suffer the consequence of paying fines and penalties. You can use a federal tax extension for a variety of reasons.

This method is handy if you cannot access specific documents. Use this service if you need more time due to unforeseen circumstances.

What Happens When You Get an Extension?

It is important to know that filing a tax extension does not give you an indefinite amount of time to complete your taxes. It will only give you six months time to complete your payment.

For example, if the tax deadline is April 15, you will have until October 15 to complete them. The key here is to tell the IRS.

Do not avoid letting them know you need more time. When you file a tax deadline extension, you are simply asking for more time.

If you did not do this, the IRS will charge significant fines and penalties to you as a result. They can charge you with late payment penalties, too.

Here’s something most people do not know. When requesting a tax extension, you are requesting more time to submit your documents.

This means you need more time to file your taxes or actual tax forms. It does not give you more time to pay your tax debt.

If you estimate that you owe $10,000 in April, you need to pay that by the tax deadline for the year, which is, generally, April 15. You must pay anything you owe at this time.

What Is the Purpose of a Tax Extension?

As mentioned, a tax extension is allowing taxpayers to file tax returns over an extended period. It does not really mean an extension for the tax payment, because a taxpayer is still subject to paying the tax owed on the due date.

The primary purpose of the extension is to give taxpayers, especially businesses, extra time to settle or complete their accounting and data required for filing.

The IRS provides a deadline to request a business tax filing extension to corporations, usually until March 15. Business partnerships and individuals, meanwhile, have until April 15 every year.

The government commonly responds to the requests, but if a taxpayer doesn’t get any response in three to four weeks they should perform a follow-up.

If you are able to prove you mailed the request on time, ultimately, the IRS should give you the tax extension.

How Does TurboTax Work?

https://www.instagram.com/p/BaUc5EUHjkC/

If you usually use TurboTax software, you can file extension requests directly on the software platform.

The company will electronically send the extension request to the IRS for you. A TurboTax file is a common method for anyone using this software.

With a TurboTax tax extension, you are able to complete most of the tasks you need to, including:

- Sending an electronic notification to the IRS requesting the extension.

- Making a payment directly to the IRS for any money you need. You can do this through your checking or your savings.

- Print off the extension request for your records.

- You will receive a notification in your email when the federal government receives your extension request. Print this off, too, for your records.

RELATED: How To File Back Taxes

How Do You File a Tax Extension Directly to the IRS?

You do not have to use any type of tax software to request an extension from the IRS. Instead, you can print off a copy of an extension request or file form from the IRS website and then follow the directions on it to learn how to file for a tax extension.

Most often, this is Form 4868: Application for Automatic Extension of Time for U.S. Individual Income Tax Return.

Form 4868 Definition: An IRS form for taxpayers that allows them to request a tax extension for filing income taxes.

Again, if you owe taxes at this point, the IRS expects you to file that payment with this form. That is important because it shows you are making a good faith decision.

If the IRS feels you are not making a fair estimate of the taxes you owe, it will deny the request. They may also charge you a late payment fee as a result.

What About State Returns?

It is possible to file a tax extension for most state tax returns. But to do so, you will need to follow the specific requirements set by your state.

This will differ from one agency to the next. It is a good idea to contact your state’s taxing authority and to request this information.

Most of the time, you can file this request online. You may be able to print forms as well.

Mailing them in is also done according to the directions provided.

What Are the Special Rules to Extend a Tax Deadline?

The IRS offers exemptions to extend a tax filing deadline under two special circumstances. The first one is if you are out of the country and it is difficult for you to file your returns.

The IRS will give you a two-month extension to settle any federal tax due and file your return, without the need to request for an extension. This applies if you are living outside of the country or Puerto Rico, your place of business is outside the country and Puerto Rico, and on military or naval duty outside of the country or Puerto Rico on the due date.

For example, for your 2018 return, the IRS will give you until June 15, 2019, to file, given that the deadline is on April 15, 2019. You should also attach a written statement explaining why you fit the special rule for extending the tax deadline for this tax year.

The second circumstance is when you are serving the Armed Forces or are deployed in a combat zone upon the deadline. It automatically extends 180 days after the last day in the combat zone or the last day of continuous hospitalization for an injury from a combat zone.

Why Is It Important to Do Your Own Tax Estimate?

Part of knowing how to file a tax extension is also knowing how to perform your own tax estimate. Doing so will allow you to know where you stand on your taxes and whether you owe something or not.

If you owe the IRS money, it is best to send the estimated tax payment along with the request for an extension primarily to avoid unnecessary fines or penalties.

If it turns out you don’t owe the government that much, the IRS will eventually send you a tax refund. If you owe more than your estimate, you will at least cut the interests and penalties to only a portion of the tax still owed.

It is a good idea to prepare your income tax return in April, even if you don’t file yet on the deadline for personal reasons. The important thing to know about how to file a tax extension is to be responsible for dealing with your tax liabilities to avoid further charges.

Don’t forget to download, save, or share this handy infographic for reference:

Check out this video on how to file a tax extension:

Whether you use a TurboTax extension or you use an IRS e-file extension, the process of filing a tax extension is not difficult. Be sure you have a solid reason for filing this request and be sure you submit any payments owed at this time.

Have you tried filing a tax extension? How did it work for you? Share your experiences with us in the comments section below!

Up Next:

- Late Tax Filing? Here’s Everything You Need To Know

- The Pros And Cons Of Filing A Tax Extension

- How To Get Your Underpayment Penalty Waived

Editor’s Note: This post was originally published on March 27, 2018, and has been updated for quality and relevancy.

![Filing Tax Extension | A Complete Guide [INFOGRAPHIC] https://help.taxreliefcenter.org/filing-tax-extension/](https://eqp5jgfqqvh.exactdn.com/wp-content/uploads/2019/03/TRC-PIN-Filing-Tax-Extension-_-A-Complete-Guide-.png?strip=all&lossy=1&ssl=1)