This comprehensive guide discusses what the IRS Fresh Start program is and how it works.

IRS Fresh Start Program: A More Accessible Collection Program

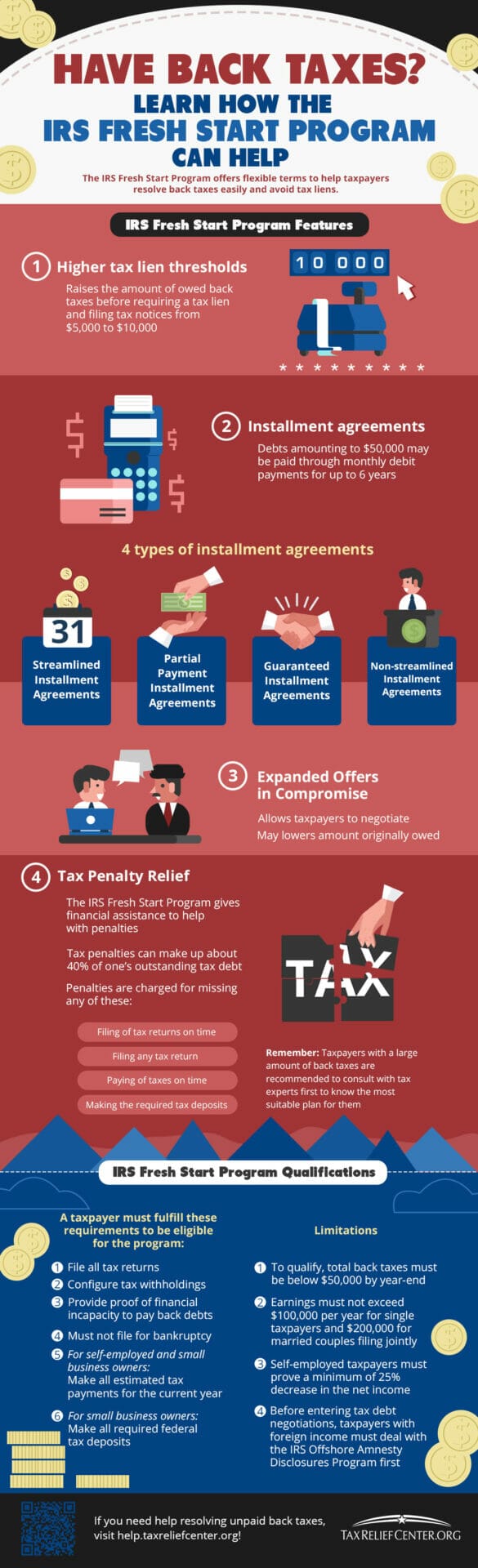

Click here to jump to the infographic.

1. What the IRS Fresh Start Program Is

The IRS Fresh Start Program came to be as a means of assisting Americans to handle IRS back taxes in an easier way. This has made it possible for millions of people across the United States to receive much-needed tax relief benefits.

2. Higher Tax Lien Thresholds

Raising the minimum amount of back taxes a taxpayer has to owe before being required a tax lien is the first major change the Fresh Start Program made. The IRS would file tax liens for people owing at least $5,000, but now no tax notice is to be filed unless the debt is more than $10,000 worth of back taxes.

This is extremely helpful because having a tax lien can have a significantly negative impact on your credit score. It will affect a citizen’s ability to borrow money, conduct business, and even sell a property.

3. Installments

The IRS Fresh Start Program also allows taxpayers to settle any debts in easier, monthly installments. The different types of payment agreements are as follows:

- Streamlined Installment Agreements

- Partial Payment Installment Agreements

- Guaranteed Installment Agreements

- Non-streamlined Installment Agreements

Taking up a Streamlined Installment Agreement, for example, can even help you minimize tax penalties.

Taxpayers with debts amounting to $50,000 can use monthly direct debit payments over the course of time as long as 6 years. There will be much less paperwork, and in most cases, the IRS won’t even ask for a financial statement.

4. Tax Penalty Relief

Tax penalties have the potential to pile up to about 40% of your outstanding debt. The IRS Fresh Start Program helps people with these penalties by giving them financial assistance.

Tax penalties are charged for missing any of the following:

- Filing of tax returns on time

- Filing any tax return

- Paying of taxes on time

- Making the required tax deposits

5. Expanded Offers in Compromise

This change in the IRS Tax Law lets taxpayers negotiate their debts with the IRS, ending up with paying a lot less than what is actually owed. It’s similar to a Tax Debt Forgiveness Program, which lets taxpayers make payments based on what they can afford without taking away too much from the original amount owed.

These changes make it even easier for taxpayers to meet the qualifications for an IRS Offer in Compromise.

Related: IRS Installment Agreement Types | How Can It Help You

6. Applying for the IRS Fresh Start Program

The IRS Fresh Start Program is an all-encompassing update to IRS tax laws instead of an actual initiative, which makes it rather tricky to apply directly. Experts recommend consulting or hiring a tax attorney, a tax professional, or a debt resolution agency to help resolve outstanding debts, especially those with large amounts of back taxes.

7. Qualifications for the IRS Fresh Start Program

Here are some things to fulfill to be eligible for the program:

- File all tax returns – If you haven’t done this recently, or have skipped a couple of years, you must settle this immediately. The IRS will not even begin to consider any negotiation with you until your tax returns have been filed.

- Configure your tax withholdings – Make sure all current withholdings are accurate and consistent for at least six months. This is so the IRS can be sure that you are being truthful about the money you are earning.

- Prove that you don’t have enough money and/or assets to pay back debts – Any tax forgiveness is extremely difficult to receive because it’s reserved only for people who cannot afford them. Unless you have proof that you can’t afford to pay your taxes, the IRS won’t entertain you.

- For the self-employed and small business owners: Make all estimated tax payments for the current year – The IRS will want to see proof that you are at least doing your part in trying to keep up with your payments, otherwise, they will refuse all attempts at negotiation.

- For small business owners and businesses with employees: Make all required Federal tax deposits – The IRS is particularly strict about this, as many businesses have been known to file for tax relief while keeping the employees’ taxes for themselves for bigger take-home pay. Simply put, that already qualifies as theft—of the employees’ money, and taxes that should be paid to the IRS. Make sure that you’re keeping up on your federal tax deposits; otherwise, do not expect any help from the IRS.

- Not be caught up in an open bankruptcy proceeding – If you’re thinking of filing for bankruptcy before asking the IRS for help, don’t. The IRS does not associate nor negotiate with taxpayers in the middle of filing for bankruptcy.

Failure to meet any of the conditions above will prevent you from accessing the benefits under the IRS Fresh Start Program.

8. Foreign Income

Taxpayers with foreign income and/or assets seeking to reduce their debts by not declaring said assets could be risking some serious jail time and even more penalties and fines. Experts recommend the IRS Offshore Amnesty Disclosures Program before coming to the IRS for tax negotiations.

9. Limitations

Unfortunately, not all taxpayers have access to the IRS Fresh Start Program. Here are the most common limitations:

- The tax balance must be below $50,000 by the end of the year to be able to qualify.

- Single taxpayers can’t earn more than $100,000 per year; for married couples filing jointly, the limit is $200,000 per year.

- Self-employed taxpayers must prove that there is at least a 25% decrease in their net income.

Don’t forget to download, save, or share this handy infographic for reference:

Still confused on how taxpayers can qualify for the IRS Fresh Start Program? Check out the video below:

The IRS Fresh Start Program has made it easier for taxpayers to pay back their debts with the IRS. Getting access to those benefits takes a lot of preparation and work, and it is highly recommended that you consider getting help from tax professionals who can guide you through the entire process.

Have you given the IRS Fresh Start Program a try? Share your experiences in the comments section below!

Up Next: 9 Tax Relief Tips You Can Do When You’re In Tax Trouble

![The IRS Fresh Start Program | How Does It Work? [INFOGRAPHIC] https://help.taxreliefcenter.org/irs-fresh-start-program/](https://eqp5jgfqqvh.exactdn.com/wp-content/uploads/2019/02/TRC-Plac-March-2019_The-IRS-Fresh-Start-Program-_-How-Does-It-Work_.png?strip=all&lossy=1&ssl=1)