When you owe back taxes to the IRS, the only responsible way to go about it is to take immediate action.

In this article:

- When You Owe Back Taxes

- Tax Debt Collection Time Limit

- Hardship Status

- Installment Agreements

- Offer in Compromise

- Bankruptcy

- Back Tax Forms

- Tax Collection Tactics

Important Things to Know When You Owe Back Taxes

When You Owe Back Taxes

What can taxpayers do if they owe back taxes? It can be a difficult situation, but some knowledge of the IRS and its collection system will help a person navigate through this problem. Remember, it is very important to resolve any issue with taxes you owe the IRS. So, here is an overview of the solutions to pay back the money you owe.

Tax Debt Collection Time Limit

There’s a law limiting the collection of IRS debt. It runs 10 years from the date of the tax assessment. If a taxpayer files a return and 10 years pass with the debt still unpaid, the IRS forfeits the chance for collection. Owing taxes is not a life sentence, but it’s still not a good practice to leave debt unattended.

Hardship Status

If the IRS determines a person doesn’t have the ability to pay, they will place the account in a status called currently not collectible. This taxpayer’s payment inability is also called hardship status. The IRS calls it status 53, so if a person talks to them mentioning the term, it somewhat impresses them.

Installment Agreements

The IRS may allow payment plans or installment agreements on how to pay off back taxes. The bad news is if a person owes them a lot of money, the IRS will force payment out of his monthly disposable income amount. This means there won’t be enough money for other expenses. The best thing to do is to keep track of debts carefully and avoid overlapping any debts.

Offer in Compromise

Offer in compromise is a way to make a deal with the IRS for less than what a person owes. If an individual tells the IRS that he can’t afford to pay, nor is he likely to pay the full amount, the issue will be dealt with to the taxpayer’s advantage.

For example, a person’s monthly disposable income is only $300 per month times 12 without any assets; the offer will be $3600 as the amount the taxpayer will pay in five months time. This kind of tax settlement has been accepted at a much higher rate but is still subject to the IRS discretion.

Bankruptcy

Taxes can be discharged in bankruptcy under certain circumstances like how income taxes can be discharged in bankruptcy while payroll taxes can’t. As long as the account is eligible, income taxes discharge can be given considerations. Here are the income tax timing scenarios:

- Due for more than three years, including extensions

- Late filing of two years

- An assessment of more than 240 days

Back Tax Forms

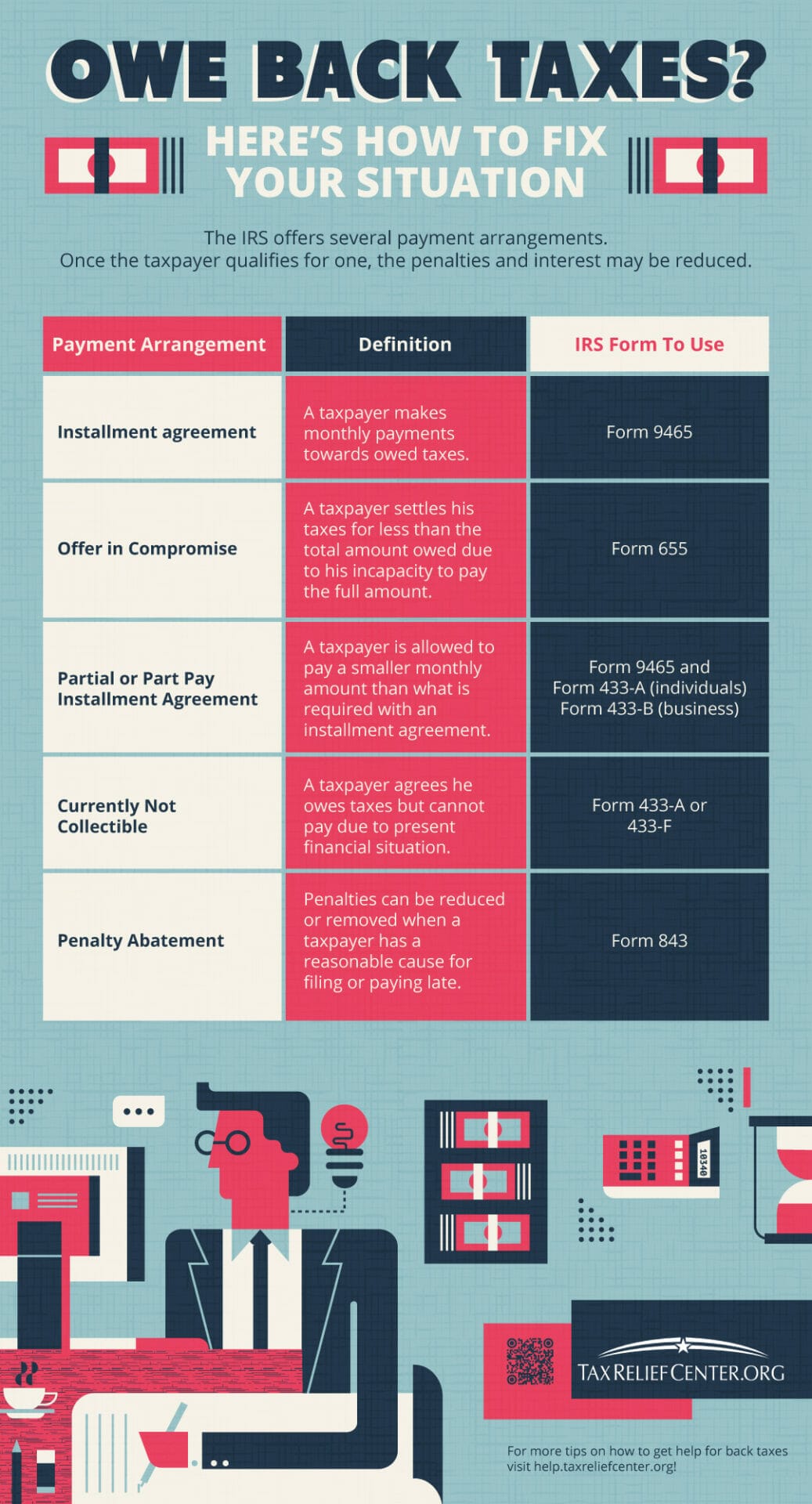

- Installment agreement

- A taxpayer makes monthly payments towards owed taxes.

- Form 9465

- Offer in Compromise

- A taxpayer settles his taxes for less than the total amount owed due to his incapacity to pay in full.

- Form 655

- Partial or Part Pay Installment Agreement

- A taxpayer is allowed to pay a smaller monthly amount than what is required with an installment agreement.

- Form 9465 and

- Form 433-A (individuals)

- Form 433-B (business)

- Currently Not Collectible

- A taxpayer agrees he owes taxes but cannot pay due to his present financial situation.

- Form 433-A or 433-F

- Penalty Abatement

- Penalties can be reduced or removed when a taxpayer has a reasonable cause for filing or paying late.

- Form 843

Tax Collection Tactics

The Internal Revenue Service (IRS) employs these collection tactics resulting from a taxpayer’s inaction despite multiple notices.

- Tax lien – Government’s legal claim against a noncompliant taxpayer’s assets.

- The taxpayer cannot sell or transfer the property until the unpaid taxes are paid.

- Wage garnishment – A court order demands the taxpayer’s employer to withhold a portion of his salary to cover unpaid taxes.

- Bank levy – Tax authorities contact the taxpayer’s bank to take funds from his account to cover unpaid tax liability.

- Property seizure – Tax authorities seize the taxpayer’s valuable assets that can be sold to cover unpaid taxes. (graphics: car, house, boat)

Download this infographic now and reference it later.

Check out this video and learn the important things to do if you can’t pay your taxes:

Knowledge of the IRS’ collection system is always a big help, but it must not be a means to exploit one’s taxpaying capabilities. This information aims to help people who owe back taxes resolve their tax problems. After all, every situation is unique, and it’s still their decision whether to pursue certain deals or not.

Can you suggest more solutions to back taxes? Share your thoughts in the comments section below!

Up Next: What Is Income Tax Preparation?

Editor’s Note: This post was originally published on February 12, 2018, and has been updated for quality and relevancy.